Microinsurance Without Borders Effective Delivery of Microinsurance for SMEs in the Agricultural Sector | Climate Finance, Ghana 2019

Published: 14 January 2020 Kathrin Kirsch, Marlena Kiefl

Microinsurance without Borders aims to strengthen the resilience of smallholder farmers towards external shocks, focusing on value chains that are strongly affected by climate change. It comprises a comprehensive solution that fits the needs of smallholder farmers by combining a mobile-enabled insurance with technical assistance for climate-resilient agriculture, as well as financial literacy training for smallholder farmers to foster a financially inclusive and climate-resilient agricultural sector in Ghana and fill the insurance gap for smallholder farmers Read more

SDGs:

Farmer Friendly Finance: Unlocking Financing for Climate-Smart Agriculture Through a Community-Based Youth Farming Approach | Climate Finance, Ghana 2019

Published: 14 January 2020 Marlena Kiefl

Farmer Friendly Finance (FFF) offers climate finance solutions to farmers, and especially young graduates, who want to set up a farming business as aspiring farmerpreneurs in the context of climate-smart agriculture. FFF bundles services to de-risk farmerpreneurs, offers access to finance and cooperates with rural communities to provide land to farmerpreneurs with the aim to address the challenge of climate change and youth migration which Ghana’s agriculture sector is facing. Read more

SDGs:

Modest in Size, Potentially Huge in Impact: Leveraging Small- and Medium-sized Enterprises (SMEs) for Climate Action

Published: 23 December 2019 Jonas Restle-Steinert, Kathrin Kirsch, Linde Wolters, Maggie Sloan, Rainer Agster, Tobias Hausotter

Despite the goals put forward in the Paris Agreement and commitments by countries in their nationally determined contributions (NDCs) the concentration of greenhouse gases in the atmosphere is rising (WMO 2019). It is, therefore, more important than ever for countries to step up their ambition and NDC commitments in 2020. The COP25 climate negotiations will pave the way for the next year and the NDC update processes. These open up the opportunity to acknowledge a modest yet potentially impactful group of players for ambitious climate action: small- and medium-sized enterprises (SMEs). Read more

SDGs:

SEED Practitioner Labs 2019

Published: 25 November 2019 Alina Weiss, Camilla Shearman, Julia Haack, Kathrin Kirsch, Maggie Sloan, Marlena Kiefl

This brochure gives an overview of the 16 climate finance solutions and policy instruments developed during the 2019 SEED Practitioner Labs Climate Finance and Policy Prototyping in Ghana, Malawi, and South Africa.

This year, the labs brought together over 320 policy makers, financial institutions, civil society, research organisations, intermediaries and eco-inclusive enterprises to co-create solutions to financial and policy barriers facing eco-inclusive enterprises as they look to start and scale their ideas. Read more

This year, the labs brought together over 320 policy makers, financial institutions, civil society, research organisations, intermediaries and eco-inclusive enterprises to co-create solutions to financial and policy barriers facing eco-inclusive enterprises as they look to start and scale their ideas. Read more

SDGs:

Climate-Smart Impact Investment Fund: Extending capital to SMEs in emerging markets | Climate Finance, South Africa 2019

Published: 24 November 2019 Maggie Sloan

The solution for an Impact Investment Fund for Climate-Smart Entrepreneurial Solutions brings together networks of active impact investors and potential future investors to deliver equity to climate-smart SMEs in their efforts to reach commercial scale. Read more

SDGs:

Platform for climate-resilient SME financing: Institutionalising access to climate finance | Climate Finance, South Africa 2019

Published: 24 November 2019 Julia Haack, Maggie Sloan

The platform will build on existing infrastructure to support investors and SMMEs by building a common understanding of the climate resilience market, facilitating investment-readiness and deal flow matchmaking processes, while building SMMEs’ capacity through a customised “capacity building journey”. Read more

SDGs:

Green Lend: Inclusive credit risk assessment across value chains | Climate Finance, South Africa 2019

Published: 24 November 2019 Maggie Sloan

This credit risk assessment mechanism aims to increase lending to climate-smart SMEs through risk scorecard development that incorporates alternative data across enterprise value chains. Read more

SDGs:

Equity plug for energy efficiency financing: Direct lending model for SMEs | Climate Finance, South Africa 2019

Published: 24 November 2019 Maggie Sloan

This model for energy efficiency financing for SMEs “plugs the gap” with equity by generating a paradigm shift in commercial banks through market, technology and supplier engagement and systematic technical assistance. Read more

SDGs:

Syndicate for Renewable Energy Infrastructure Financing | Climate Finance, Uganda 2018

Published: 09 July 2019 Alina Weiss, Maggie Sloan

The syndicate for renewable energy infrastructure financing solution contracts a community of interested debt and equity lenders to finance household RE projects. It enables and leverages syndication effects to increase the number of new financial partnerships, raise debt in the RE sector and multiply returns on investments. Investors are legally bound in the syndicate, which finances RE infrastructure projects based on comprehensive project analysis, due diligence and evaluation. High ROI potential projects receive financing through insurance, blended financing or otherwise, depending on the financing service offerings of member financiers. The syndicate supports RE infrastructure projects to plan project implementation and schedules payments accordingly. Read more

SDGs:

Mobile-Enabled Microinsurance for Climate Resilient Agriculture | Climate Finance, Uganda 2018

Published: 09 July 2019 Alina Weiss, Maggie Sloan

The mobile-enabled microinsurance solution catalyses mobile-based technology to increase access to and improve the quality of agriculture insurance solutions offered to small-scale agribusinesses in Uganda. This product insures small-scale agribusinesses who produce commercial crops against production losses, monitored using real-time weather indexing. Product delivery, servicing and claims pay-outs are facilitated by a network of insurance agents supported by local-level representatives and mobile-money and communication technology. Read more

SDGs:

Irrigation System Microleasing for High-Value Crops | Climate Finance, Uganda 2018

Published: 08 July 2019 Alina Weiss, Maggie Sloan

The irrigation system microleasing for high-value crops solution mitigates investment risks for both farmers and financial institutions. The irrigation system financing model directs financing for climate-smart irrigation technologies through technology providers to agribusinesses that produce (or have the potential to produce) commercial crops that generate higher profits at market. The financing mechanism for irrigation systems engages the private sector to maximise returns on investment in productive farm assets (specifically irrigation) in the agriculture sector. Read more

SDGs:

A Year at SEED | 2018

Published: 31 January 2019

Our annual visual report (A Year at SEED | 2018) celebrates achievements across both our Direct Enterprise Support and Ecosystem Building programmes plus shares our involvement in key high-level dialogues and milestones in organisational development, while introducing you to this year's SEED Low Carbon Award Winners who offer innovative solutions for climate change adaptation and mitigation. Read more

SDGs:

SEED-supported enterprises applauded as green economy innovators at PAGE

Published: 15 January 2019

The 2019 PAGE Ministerial Conference drew attention to "Advancing Inclusive and Sustainable Economies" on 10 and 11 January 2019. By participating in the conference in Cape Town, South Africa, SEED highlighted the importance of supporting small and medium sized enterprises (SMEs) to realising and strengthening inclusive and green economies. Read more

SDGs:

Eco-inclusive enterprises get a stake in green economy agendas during GEC discussions

Published: 14 January 2019

SEED backed smaller eco-inclusive enterprises to #GetAStake in the Green Economy transition during action-oriented discussions at the Green Economy Coalition Global Meeting 2019. Read more

SDGs:

Climate-smart innovation and how to adopt a polar bear

Published: 21 December 2018 Kathrin Kirsch

Florian Rehm, participant from our Practitioner Lab Climate Finance in Thailand, developed the cutting-edge prototype for Last of Ours that merges digital innovation based on the blockchain, social entertainment and real-world impact for our planet’s endangered species and natural zones. Read more

SDGs:

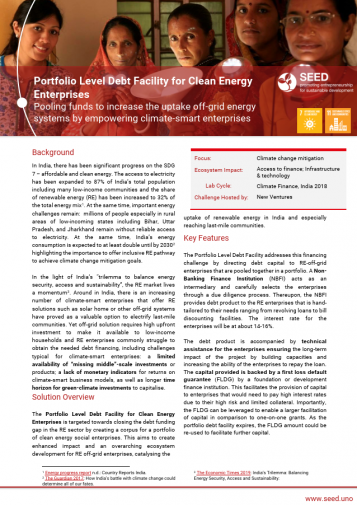

New Ventures: Portfolio Level Debt Facility for Clean Energy | Climate Finance, India 2018

Published: 20 December 2018 Kathrin Kirsch

The Portfolio Level Debt Facility for Clean Energy Enterprises is targeted towards closing the debt funding gap in the RE sector by creating a corpus for a portfolio of clean energy social enterprises. This aims to create enhanced impact and an overarching ecosystem development for RE off-grid enterprises, catalysing the

uptake of renewable energy in India and especially reaching last-mile communities. Read more

uptake of renewable energy in India and especially reaching last-mile communities. Read more

SDGs:

Wildchain: A Non-profit Conservation Innovation Lab | Climate Finance, Thailand 2018

Published: 20 December 2018 Kathrin Kirsch, Marlena Kiefl

Wildchain brings people together to protect our planet’s endangered species and ecosystem by creating shared value between social entertainment and real-world impact. Wildchain lets people digitally adopt and raise some of earth’s rarest species within a digital sanctuary they can call home. Users are passively contributing to conservation and reforestation projects solely by participating in this entertainment ecosystem. Users may also actively allocate where their donations go on a fully transparent kickstarter-like platform which will represent the impact they have created. Read more

SDGs:

Smart-Irrigation-as-a-Service Financing Vehicle | Climate Finance, Thailand 2018

Published: 20 December 2018 Kathrin Kirsch

The Smart-Irrigation-as-a-Service Financing Vehicle directs deal flow for drip-irrigation systems to improve productivity and climate adaptation capacities to small and growing agri-enterprises. This financial instrument offers microfinancing solutions to lower investment risks in agricultural process improvements for both farmers and financial institutions. Read more

SDGs:

TARA: Green SME Finance Tool | Climate Finance, India 2018

Published: 20 December 2018 Kathrin Kirsch

The Green MSME Finance Tool is a knowledge platform positioned as a one-stop source for organised financial information about green MSMEs, credit appraisal and rating systems for green technology solutions and potential monetisation of green solutions. It provides banks with data and frameworks to understand green technology-based enterprises and evaluate them for financing in order to bridge the information gap between banks and green enterprises and thereupon reducing otherwise high due diligence costs. Read more

SDGs:

Gold Standard Programme of Activities: Unlocking the carbon market for waste-management enterprises | Climate Finance, India 2018

Published: 20 December 2018 Kathrin Kirsch

The Gold Standard Programme of Activity (PoA) for Waste Management Start-Ups developed by VNV Advisory and GIZ is an umbrella programme that bundles several emissions reducing activities that can earn carbon credits. The PoA enables carbon revenue for SMEs including small-scale projects involved in waste management in key community-oriented areas such as households and commercial waste. Read more

SDGs:

GROVE: Blockchain-based conservation plaform for regenerative mangrove forestry | Climate Finance, Thailand 2018

Published: 20 December 2018 Kathrin Kirsch

GROVE – the Global Reforestation Objective Virement Ecosystem – is set up by the Global Mangrove Trust (GMT). GROVE is a digital platform that runs as a decentralised foundation utilising smart contracts and satellite verification to crowdfund forest growth. Read more

SDGs:

Joining forces for eco-inclusive Climate Action at COP24

Published: 19 December 2018 Maggie Sloan

As global leaders joined together in Katowice to determine the future of our planet, our SEED team was present at COP24 to demand that Climate Action takes the lead of SEED-supported small and growing enterprises. Read more

SDGs:

SEED exhibits innovation in Climate Action at COP24

Published: 19 December 2018

This year at COP24 in Katowice, SEED showcased the success stories of SEED-supported enterprises across sectors and urged stakeholders from private, public and social sectors to acknowledge and bolster the transformative role of entrepreneurship in combatting climate change and furthering sustainable development. Read more

SDGs:

SEED Practitioner Labs Climate Finance | Thailand 2018

Published: 18 December 2018

The 2018 SEED Practitioner Labs Climate Finance series in India, Thailand and Uganda brought together around 200 leading practitioners to jointly prototype tangible solutions to major climate finance challenges. This report summarises the innovative climate finance products developed as part of the SEED Labs process in Thailand in primary partnership with Global Mangrove Trust with KX, Last of Ours with KX, South Pole and RCC UNFCC/IGES with UNDP. Read more

SDGs:

SEED Practitioner Labs Climate Finance | India 2018

Published: 18 December 2018

The 2018 SEED Practitioner Labs Climate Finance series in India, Thailand and Uganda brought together around 200 leading practitioners to jointly prototype tangible solutions to major climate finance challenges. This report summarises the innovative climate finance products developed as part of the SEED Labs process in India in primary partnership with TARA with Grameen Capital, New Ventures and GIZ with VNV Advisory. Read more

SDGs: